Table of Contents

Introduction

In recent years, student loan debt has become a significant concern for many individuals seeking higher education in the United States. President Joe Biden’s student loan forgiveness plan has generated considerable attention and discussion among students, graduates, and policymakers. In this beginner’s guide, we will delve into the details of the Biden student loan forgiveness plan, its implications, and how it may affect borrowers. So, let’s get started!

Understanding the Biden Student Loan Forgiveness Plan

What is the Biden Student Loan Forgiveness Plan?

The Biden student loan forgiveness plan is a proposed initiative aimed at addressing the growing burden of student loan debt. It outlines several key provisions that seek to alleviate the financial strain on borrowers and improve accessibility to higher education. While the plan is yet to be fully implemented, it offers potential solutions for those struggling with student loan repayment.

Key Features and Benefits

- Expanded Public Service Loan Forgiveness (PSLF): The Biden plan aims to expand the PSLF program, making it easier for public service workers to qualify for loan forgiveness after ten years of service.

- Income-Driven Repayment (IDR) Changes: The plan proposes changes to income-driven repayment plans, reducing the repayment burden on low-income borrowers by capping their monthly payments at a certain percentage of their discretionary income.

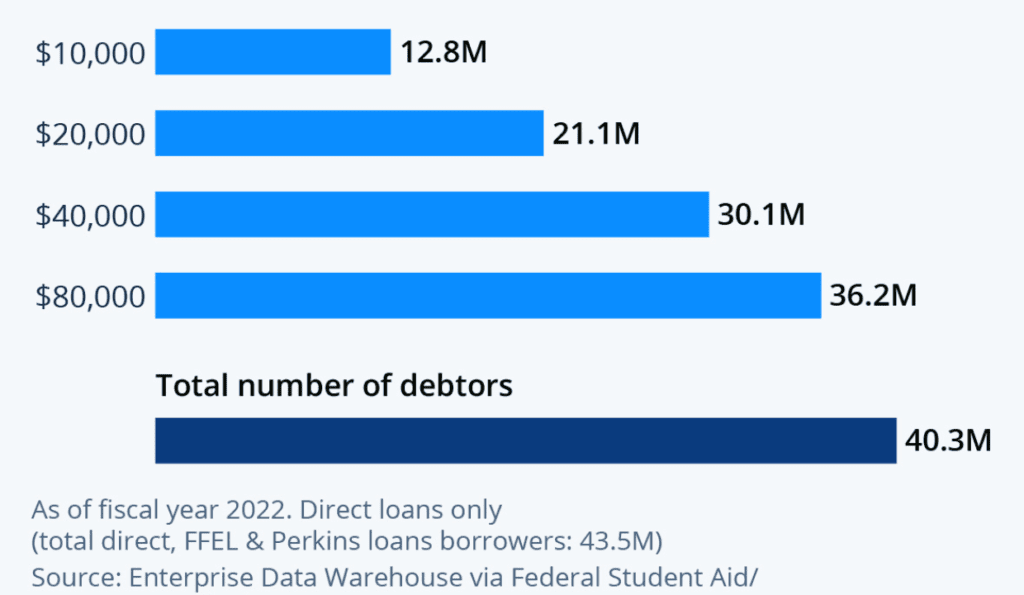

- $10,000 Loan Forgiveness: President Biden has expressed support for canceling up to $10,000 in student loan debt for all borrowers, providing much-needed relief to millions of Americans.

- Support for Historically Black Colleges and Universities (HBCUs): The plan seeks to invest $70 billion in HBCUs, aiming to improve access to higher education for underrepresented communities and promote equality in education.

How Does the Biden Student Loan Forgiveness Plan Compare to Existing Programs?

The Differences and Similarities

While the Biden student loan forgiveness plan introduces new provisions, it also builds upon existing programs. Here’s a comparison of the plan with some existing initiatives:

- Public Service Loan Forgiveness (PSLF): The Biden plan expands upon the PSLF program by eliminating some of the complex eligibility requirements, such as the need to work for a qualifying employer. This change will open up loan forgiveness opportunities for a broader range of public service workers.

- Income-Driven Repayment Plans: The proposed changes to income-driven repayment plans aim to simplify the application process and make them more accessible to borrowers. The plan seeks to lower the repayment burden for those with lower incomes.

- Loan Forgiveness Amount: While the Biden plan supports up to $10,000 in loan forgiveness for all borrowers, it falls short of more ambitious proposals calling for larger-scale debt cancellation.

Potential Implications and Considerations

The Impact on Borrowers

The Biden student loan forgiveness plan offers hope for many borrowers struggling with student loan debt. If implemented successfully, it could provide significant relief and improve financial stability for millions. However, it’s important to consider some potential implications and factors to keep in mind:

- Budgetary Constraints: Implementing the plan requires navigating complex budgetary considerations. It may face opposition or require modifications to gain sufficient support from lawmakers.

- Debate and Negotiation: The specifics of the plan may undergo changes during the legislative process. It’s essential to stay informed about any updates or modifications that might affect borrowers.

- Tax Implications: Loan forgiveness may have tax implications for borrowers. It’s crucial to understand the potential tax consequences and seek professional advice to make informed financial decisions.

Conclusion

The Biden student loan forgiveness plan holds the promise of addressing the mounting student loan debt crisis in the United States. While it offers potential relief for borrowers, its implementation and effectiveness depend on various factors. By expanding existing programs, introducing new provisions, and focusing on equity in education, the plan seeks to make higher education more accessible and alleviate the burden on borrowers.

Remember

staying informed about updates and changes to the Biden student loan forgiveness plan is crucial. It is equally important to seek guidance from professionals and understand your specific circumstances before making any financial decisions related to your student loans.

FAQ

- What is the Biden Student Loan Forgiveness Plan? The Biden Student Loan Forgiveness Plan is a proposal by President Joe Biden to provide relief to borrowers burdened by student loan debt. It aims to reform the existing student loan system and make it more affordable for individuals by offering various options for loan forgiveness, income-driven repayment plans, and expanding Public Service Loan Forgiveness (PSLF) programs.

- How does the Biden Student Loan Forgiveness Plan work? The specifics of the Biden Student Loan Forgiveness Plan are still being developed, but it includes several key components. These may include expanding income-driven repayment plans, which would cap monthly loan payments at a percentage of the borrower’s income. Additionally, the plan may offer targeted loan forgiveness for certain groups, such as public servants, teachers, and individuals with low incomes.

- Who qualifies for the Biden Student Loan Forgiveness Plan? The eligibility criteria for the Biden Student Loan Forgiveness Plan have not been finalized. However, the plan is expected to prioritize borrowers with low incomes, public servants, and individuals working in certain professions that contribute to the community or public good. It is important to stay updated on the latest developments and official guidelines once they are released.

- What types of student loans are eligible for forgiveness under the Biden plan? The specific details regarding which types of student loans will be eligible for forgiveness under the Biden plan have not been fully outlined. However, the plan is expected to encompass federal student loans, including Direct Loans, Federal Family Education Loans (FFEL), and Perkins Loans. Private student loans may not be included in the forgiveness provisions, as they are typically issued by private lenders and are subject to different regulations.

- How much student loan forgiveness can I expect under the Biden plan? The exact amount of student loan forgiveness under the Biden plan is not yet determined. However, the plan may propose targeted loan forgiveness amounts for specific groups of borrowers, such as those with low incomes, public servants, or teachers. It is important to follow official announcements and updates to understand the potential forgiveness amounts and who would be eligible for them.

- Will the Biden Student Loan Forgiveness Plan cancel all of my student debt? The Biden Student Loan Forgiveness Plan is unlikely to cancel all student debt for every borrower. While the plan may propose loan forgiveness options, the extent of forgiveness will depend on various factors such as income, profession, and public service. It is important to stay informed about the details and limitations of the plan once they are officially announced.

- Are private student loans included in the Biden Student Loan Forgiveness Plan? Private student loans are typically issued by private lenders and are not guaranteed or regulated by the federal government. As a result, private student loans are less likely to be included in the Biden Student Loan Forgiveness Plan. The plan is expected to primarily focus on federal student loans, but it’s always important to review the official guidelines and announcements for specific details.

- Can I still qualify for the Biden Student Loan Forgiveness Plan if I am in default on my student loans? While the details of the Biden Student Loan Forgiveness Plan have not been finalized, it is possible that borrowers in default on their student loans may still have options to participate in the plan. However, it is crucial to rectify the default status by either rehabilitating or consolidating the loans to become eligible for forgiveness or other repayment options. It is recommended to consult with a student loan advisor or keep track of official guidelines for accurate information.

- When will the Biden Student Loan Forgiveness Plan go into effect? The specific implementation date for the Biden Student Loan Forgiveness Plan has not been determined yet. The plan needs to go through legislative processes, which can take time. It is advisable to follow official announcements and stay informed about the progress of the plan to know when it might take effect.

- How can I apply for the Biden Student Loan Forgiveness Plan? As of now, the Biden Student Loan Forgiveness Plan is still in the proposal stage, and the application process has not been established. Once the plan is implemented, there will likely be a formal application process provided by the relevant federal agencies. It is important to monitor official sources, such as the Department of Education or related government websites, to obtain accurate information on how to apply for the plan once it becomes available.

Chatbot Investing 101: A Comprehensive Guide for Beginners to Earn Passive Income